Recent incidents have highlighted the growing interest of cybercriminals in cryptocurrency theft, including deceptive tactics like fake relationships and investment scams. Reports indicate significant financial losses due to crypto fraud, emphasizing the need for robust monitoring measures. This article explores the risks associated with cryptocurrency, identifies vulnerable cryptocurrencies, and emphasizes the importance of transaction monitoring with a reliable KYC provider like FACEKI.

Cryptocurrency Scams and Losses:

According to the Federal Trade Commission (FTC), crypto romance fraud alone resulted in approximately $139 million in losses in 2021. Additionally, over $1 billion was reported lost to crypto scams from January 2021 to March 2022, with the actual figures likely higher due to underreporting. These alarming statistics highlight the prevalence of scams and the urgent need for preventive measures.

Vulnerable Cryptocurrencies:

The Binance Smart Chain (BSC) and Ethereum (ETH) have been particularly targeted by theft, with numerous incidents reported in 2022. BSC experienced a surge in thefts, with the cryptocurrency being stolen 50 times, while ETH suffered losses in 33 instances. Bitcoin (BTC) remains the most targeted cryptocurrency, with 94 crypto-related scams involving its theft since 2021.

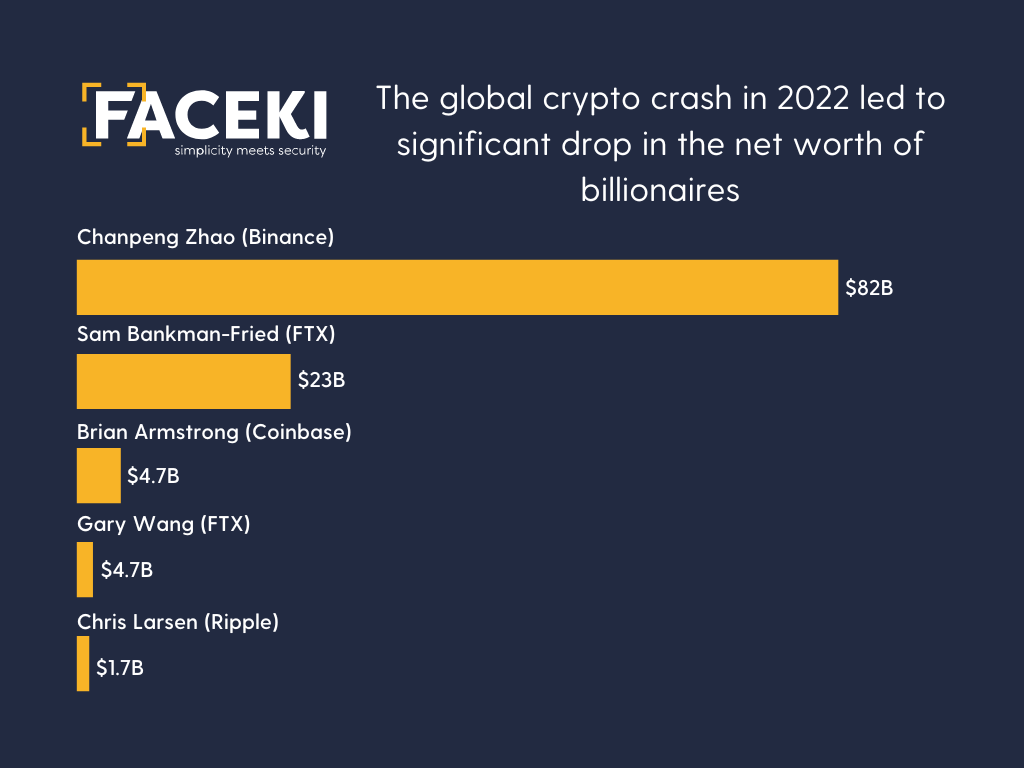

Impact on Billionaires and Crypto Exchanges:

The cryptocurrency crisis of 2022 had severe consequences for industry leaders. Binance founder and CEO Changpeng Zhao suffered the largest monetary loss, amounting to $82 billion. Similarly, FTX founder and CEO Sam Bankman-

Fried lost $23 billion and faced legal troubles related to securities fraud, money laundering, and wire fraud. Regulatory actions and liquidity crises led to FTX filing for bankruptcy.

Red Flags and Money Laundering in the Crypto Sector:

Various signs indicate potential money laundering activities in the crypto sector. These include unusual transactional behavior, transactions involving high-risk countries, structured transactions to avoid reporting thresholds, anonymous transactions using privacy coins, and inefficient Customer Due Diligence (CDD) processes. Money launderers may also exploit financially vulnerable individuals as money mules for conducting transactions.

Importance of Transaction Monitoring and KYC:

As governments implement stricter regulations, crypto firms must adopt transaction monitoring practices. Non-compliance can result in heavy fines, legal issues, damaged business reputation, and increased vulnerability to crypto fraud.

Here’s where a reliable KYC provider like FACEKI plays a crucial role. FACEKI offers robust Know Your Customer (KYC) solutions that enable crypto firms to verify the identities of their customers, detect suspicious activities, and comply with regulatory requirements. By leveraging FACEKI’s advanced technology and comprehensive database, crypto businesses can enhance their transaction monitoring capabilities and safeguard against fraudulent transactions.

Consequences of Non-Compliance:

Crypto firms that fail to implement transaction monitoring solutions may face severe penalties and negative consequences. These include substantial compliance fines, legal battles, reputational damage, and increased susceptibility to fraudulent activities. Recent cases, such as Robinhood’s $30 million fine for AML and cybersecurity violations, demonstrate the enforcement of regulations worldwide.

The dark side of cryptocurrency, marked by fraud and theft, necessitates proactive measures such as transaction monitoring and robust KYC solutions. Vulnerable cryptocurrencies, high-profile losses, and regulatory actions underscore the urgency of deploying comprehensive monitoring practices with a trusted KYC provider like FACEKI. By adhering to regulatory requirements and leveraging advanced technology, crypto firms can protect their businesses, customers, and the integrity of the cryptocurrency ecosystem while mitigating the risks posed by cybercriminals.